The Future of the Northern Sea Route - A “Golden Waterway” or a Niche Trade Route

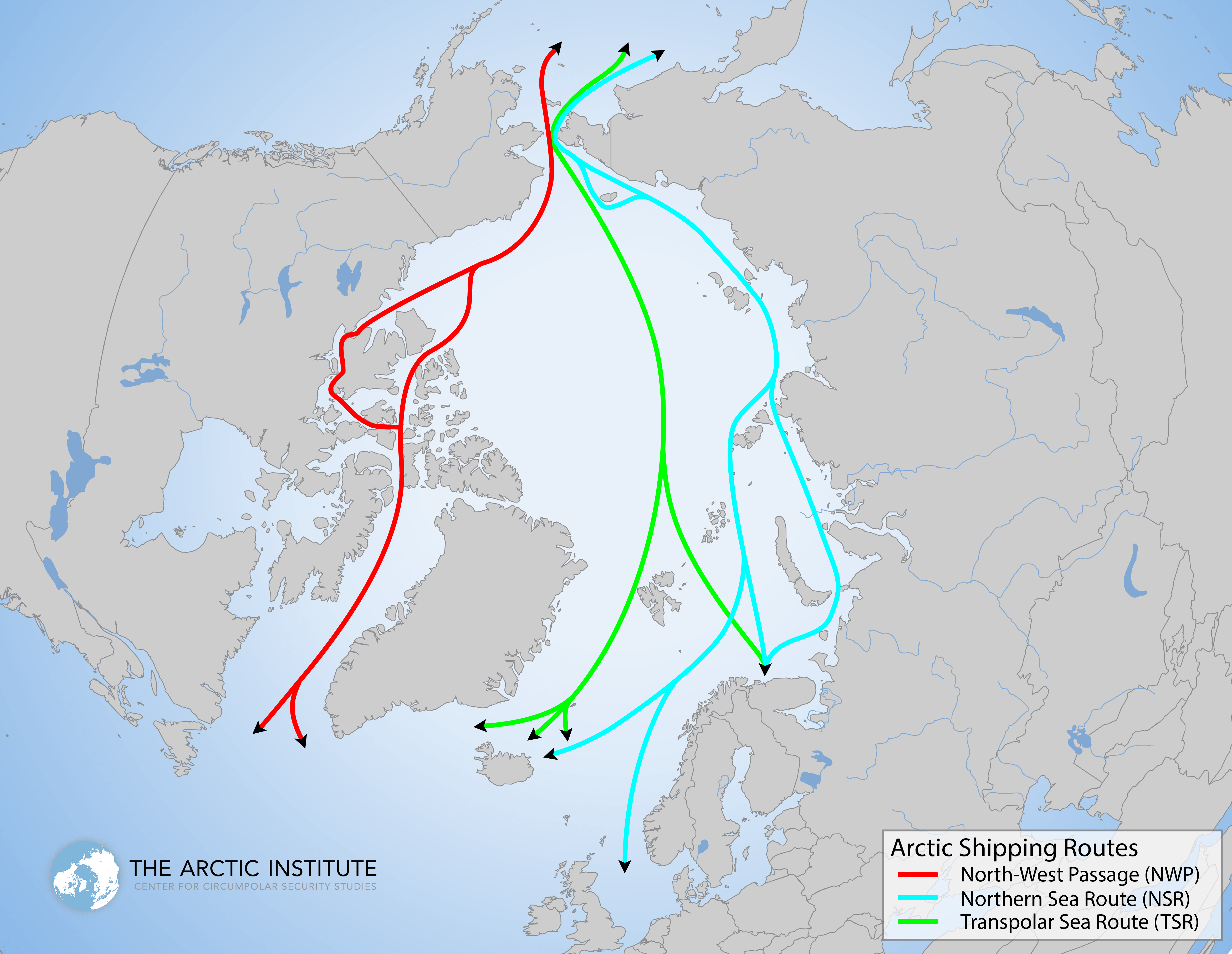

Map showing the Northern Sea Route, the Northwest Passage and the Transpolar Sea Route. Map: The Arctic Institute

With the beginning of fall just two days away, the sun at the North Pole is about to dip below the horizon for the next six months and the Arctic summer, which saw a new record low ice extent, is coming to a close. For the first time since the beginning of satellite measurements not only the Northern Sea Route (NSR) but also all channels along the Northwest Passage (NWP) appeared to be virtually ice free for an extended period of time.

“These waterways were of little interest to shipping companies when thick “multiyear” sea ice choked the waters along Canada and Russia’s northern coasts. But now, climate change is causing the ice to thin and recede. Since 2007, in late summer, both the Northwest Passage and Northern Sea Route have been temporarily ice-free. Within the next decade, the Arctic could experience a complete late-season melt-out – and, with that, a permanent loss of the multiyear ice.”1)

Shipping traffic along the NSR is expected to double this year due to increases in the size and frequency of ships traveling along the route. In 2010 the Danish 40,000 ton MV Nordic Barents was the first non-Russian bulk carrier to use the NSR as a transit trade route. This year, the Japanese bulk carrier Sanko Odyssey, a ship almost twice its size, delivered iron ore from Murmansk, Russia to Xingang, China. Summer 2011 also saw the first supertanker, the 160,000 ton Suezmax-class Vladimir Tihkonov, using the shortcut from Europe to Asia.

While sustained sailing speeds along the NSR do not yet rival those along the world’s major shipping routes, they are likely to continue to increase as first year drift ice becomes less likely to present a serious obstacle during the summer months. The Vladimir Tihkonov maintained an average speed of 14 knots and sailed from Novaya Zemlya to the Bering Strait in seven and a half days surpassing the record set by the 74,000 ton Panamamax-class STI Heritage earlier this year.

Growing economic activity in the Arctic invites questions about the medium- and long-term prospects of shipping along the NSR. Do Arctic shipping routes, especially the NSR, represent a commercially viable alternative to traditional shipping routes? What are the crucial variables in predicting the future of Arctic shipping?

Shipping companies and supporters of increased traffic in the region cite significant cost savings for ships that have sailed along the NSR and predict a rapid growth of Arctic shipping. Bulk carrier tonnage may increase tenfold, from 2 million tons today to 20 million tons by 2020, and oil and gas volume is predicted to grow along similar lines to 40 million tons per year by the end of the decade.

Researchers and shipping experts, however, remain skeptical about the commercial viability of the NSR. Canadian and American maritime experts say two percent of global shipping could be diverted to the Arctic by 2030, reaching 5 percent by 2050. Experts cite a number of factors which may determine the future growth of shipping in the Arctic. This series about the Northern Sea Route will explore how global trade dynamics and world trade patterns, the severity and speed of ice decline, fuel cost savings and transit fees, Russia’s Arctic natural resources development, and the emergence of China, South Korea and Japan as Arctic maritime nations, may influence the development of the NSR.

By examining the individual factors this series hopes to provide a framework for understanding whether the NSR will develop into a “Golden Waterway” or will remain a limited and seasonal trade route.

Global trade dynamics and World Trade Patterns

Growing economic activity in the Arctic invites questions about the medium- and long-term prospects of shipping along the Northern Sea Route (NSR). Do Arctic shipping routes, especially the NSR, represent a commercially viable alternative to traditional shipping routes? What are the crucial variables in predicting the future of Arctic shipping? Part 2 looks at global trade dynamics and explains if the NSR would be compatible with world trade patterns.

The NSR represents a shortcut for the transfer of goods between Europe and Asia and thus offers significant cost savings for shipping companies. In theory, distance savings along the NSR can be as high as 50% compared to the currently used shipping lanes via Suez or Panama. Whereas a voyage from Japan to Europe takes roughly 29 days via the Cape of Good Hope and 22 days via the Suez Canal, it takes just 10 days via the Arctic Ocean.2) The actual sailing distance between Yokohama in Japan to Rotterdam in the Netherlands is roughly 20,000 kilometers passing through the Suez Canal, but less than 9,000 kilometers via the NSR.

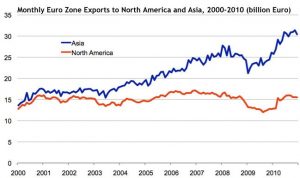

Over the past decade, Asia has overtaken North America as the largest market for European exports and the doubling of world trade by 2020 will further increase the importance of shipping lanes.3) The attractiveness of the NSR as a shorter connection between Europe and Asia may increase further as container ship operators adopt “super-slow steaming” in order to reduce fuel consumption and costs.4)

The majority of cargo ships that ply the world’s oceans operate on regular schedules, called liner service. In total more than 6,000 ships, most of them container ships, follow a set route calling at a number of ports to load and unload cargo. The global maritime industry operates on just-in-time cargo deliveries. The ability to schedule journeys long-time in advance and to guarantee uninterrupted service are key for container ship operators.

The lack of schedule reliability along Arctic shipping routes represents a major obstacle to developing the NSR. The Arctic Ocean off the coast of Northern Russia may be ice free anywhere from late June until November. During some years the ice recedes early during the season and does not return until late into Fall, while in other years the ice-free period may be as short as six weeks. Simply put, there are no guarantees when ice-free conditions start or end. In addition, throughout the summer drift ice originating further north is likely to be pushed into the shipping lanes by wind and ocean currents. Even during the summer months Arctic weather remains unstable. Fog, poor visibility, and violent winds may interrupt the pace of regular liner services.

Between Murmansk and the Bering Strait the NSR passes along 2500 miles of nearly uninhabited Siberian tundra. The lack of infrastructure and suitable ports along the route renders ships unable to receive timely assistance in case of mechanical breakdowns or damage. Operating in such remote regions under harsh climatic conditions naturally translates into higher insurance premiums for cargo ship operators.

The world’s major container lines optimize their routes along a network of ports that offer developed communication lines into the hinterlands, e.g. river transport and railroads, to distribute goods to customers and consumers. As the NSR passes through mostly uninhabited territory no such stopovers are possible, strongly reducing the route’s attractiveness for regular liner service operators.

Bulk dry carriers, such as the iron ore carrier Sanko Odyssey, in contrast, follow less predictable schedules and their routes depend more on changing supply and demand of less time sensitive items. The NSR may also benefit from Russia’s oil and natural gas developments in the Arctic. As the tundra’s permafrost begins to thaw the construction of pipelines and railways will prove ever more challenging and hydrocarbon resources may increasingly be exported via the NSR.

The NSR offers significant distance savings between Europe and Asia, but scheduling uncertainty due to the Arctic environment and the lack of infrastructure in the hinterland, will prevent the route from becoming popular with liner services. For bulk dry carriers and wet carriers, in contrast, the route may increasingly represent an alternative to more traditional shipping routes.

Climate Change in the Arctic and the NSR

Part 2 of the series on the future of the Northern Sea Route discussed global trade dynamics and explained if the NSR would in fact be compatible with world trade patterns. Part 3 will take a closer look at climate change in the Arctic and its impact on the future of the NSR. How quickly do scientists expect the remaining summer ice to disappear and at what stage could year-round operations along the NSR commence?

The regional impact of global climate change has been most amplified in the Arctic, where the annual average temperature has increased at double the global rate over the last 100 years. The Arctic is now warmer than is has been at any time during the last 2,000 years.5) The Arctic Ocean, which has had perennial ice cover for the past 700,000 years, is on a trajectory to a new, seasonally ice-free, state.

The Intergovernmental Panel on Climate Change (IPCC) estimates that over the next century, Arctic temperature increases will exceed the global annual mean by a factor of four and will range between 4.3 degrees Celsius (°C) and 11.4°C in the winter and 1.2°C and 5.3°C in the summer.6) This temperature rise will continue to have dramatic effects on Arctic sea-ice extent, which has diminished 40 percent between 1979 and 2010.7)

Over this same period, the Arctic sea ice has thinned considerably, experiencing a decline in average volume of 70 percent.8) The reductions in both sea-ice extent and volume render the remaining ice more vulnerable to secondary risk factors, such as changing wind patterns, ocean circulation, and reduced sea-ice albedo.9) As a general rule, first-year ice is more likely to melt during the summer months than multiyear ice, since ice that survives the summer is able to harden and become denser during the following winter. The Arctic has witnessed rapid loss in multiyear ice: whereas in 1988 the vast majority of ice was between four and 10 years old, by 2005 the majority of ice was less than four years old.

Studies differ widely in their predictions of when summer sea ice will melt completely. Current climate models tend to underestimate the rate of sea ice retreat.10) Prior to the events of 2007, the IPCC forecasted an ice-free Arctic for the latter part of the twenty-first century.11) The panel reported that “the projected reduction [in global sea ice cover] is accelerated in the Arctic, where some models suggest that summer sea ice cover could disappear entirely in the high-emission A2 scenario in the latter part of the 21st century.”12)

Most studies published since the sea ice collapse of 2007 expect a dramatic reduction of summer ice by the mid-2020s. In an interview with National Geographic, Mark Serreze from the National Snow and ice Data Center (NSIDC) in Boulder, Colorado is on record saying the Arctic’s summer sea ice will fully melt around 2030. Other scientists do not expect the summer ice to survive beyond 2017.13)

The NSR cannot be thought of as one clearly defined linear route, but should instead be understood as the whole sea area north of Russia. Due to highly variable and difficult ice conditions along most of the NSR, the optimal route choice for vessels navigating the NSR will vary. These navigational challenges throughout the Arctic have prompted the American defense contractor and industrial corporation Raytheon, to develop an Arctic Monitoring and Prediction program (RAMP). RAMP provides “mechanisms to collect, analyze, predict, and rapidly share data [..] which provides operational users key information in real time on critical topics such as ocean currents, shortest and safest navigational routes, ice concentration, open shipping lanes, and natural resource locations.”

Thus far ships only travel along the coastal NSR and stay within 120 miles of the shore. They must also pass to the south of numerous islands in the Laptev and Kara Sea as ice continues to exist further north throughout the summer. In contrast to the transit NSR, the costal NSR has significant draught and beam restrictions. Hence, one of the often cited advantages of the NSR, the lack of size restrictions, will only materialize once areas to the north become ice free as well. Currently, ships that are too large to pass through the Panama and the Suez Canal, such as most Very Large (VLCC) and Ultra Large Crude Carrier (ULCC), as well as Capesize container ships, are also too large to travel the NSR.

A study on Arctic marine shipping commissioned by the Arctic Council estimates that the NSR will be navigational without the assistance of icebreakers for 90-100 days only by 2080.14) Even then ships traveling along the route would still require ice-breaker assistance during the rest of the year and year-round operations cannot be guaranteed. This study may, however, underestimate the speed at which the route is opening up. The 2011 shipping season along the NSR is expected to last almost 4 months. Once ice free and light ice conditions can be more or less guaranteed for several months the route may become more attractive for shipping owners. Shipping companies are increasingly using moderately ice-strengthened vessels which can operate earlier during the summer and later into the fall. The use of ice-strengthened vessels may eventually prompt Russia to reduce its ice breaker fees or abolish the escorts all together. This would reduce costs and improve competitiveness for shipping along the NSR.

While shipping traffic along the NSR may soon be technically feasible year round, ice will continue to hamper large-scale operations over the coming decades. As long as the northern sections of the NSR remain choked with ice VLCC, ULCC and Capesize ships will not venture into the Arctic, but instead continue to travel along the traditional shipping routes.

Cost Savings Along the NSR

Part 3 of the series on the future of the Northern Sea Route (NSR) took a closer look at climate change in the Arctic and its impact on the future of the shipping in the High North. Part 4 will analyze the potential for cost savings along the NSR and discusses how credible these claims are.

Reliable figures about actual cost savings along the NSR are limited since less than two dozen commercial vessels traversed the NSR since 2010. Cost savings along the NSR are closely linked to savings in fuel costs. Shipping operators can achieve fuel cost savings in two ways:

A vessel traveling from Murmansk to Yokohama via the NSR will, on average, arrive at its destination seven days earlier than the same vessel sailing through the Suez Canal. Due to the shorter sailing distance the shipping operator realizes fuel cost savings. The operator also derives savings from the reduced number of days at sea which allows the the ship to make more return trips within a given time period resulting in increased revenue and potentially greater profits. Instead of realizing time savings, operators can also adopt super-slow sailing which more than doubles fuel efficiency. Due to the shorter length of NSR, a ship going from Murmansk to Yokohama can reduce its speed by 40 percent and still arrive in Japan at the same time as a ship sailing at full speed traveling through the Suez Canal. Especially for bulk shipping operators transporting low-value raw materials, such as ore, the primary incentive to travel along the NSR may not be the reduced lead time, but fuel cost savings.

According to Christian Bonfils, CEO of Nordic Bulk Carriers, the operator of the MV Nordic Barents which in 2010 sailed along the NSR from Norway to China, fuel savings were in the range of $550,000 when compared to a journey around the Cape of Good Hope.15) He further explained that the costs for ice-breaker services amounted to $210,000 which he stated were comparable to transit fees for the Suez Canal. Sovcomflot’s Deputy General Director Igor Pankov, in contrast, acknowledges that fees for the Suez Canal are less than ice-breaker assistance fees, but states that “when time and fuel savings are taken into account the picture changes.” In addition he expects transit and ice-breaker fees to come down once more ships start sailing the NSR.

Thus far only small and specialized operators have achieved cost savings along the NSR. How likely is it that these cost savings will materialize for a greater range of operators in the future?

Cost savings are closely linked to the origin-destination pair. While a trip from Murmansk to Yokohama is significantly shorter (by 7 days) along the NSR, a trip to Shanghai is not (2 days).16) For some routes, e.g. from Rotterdam to Singapore or Hong Kong, it is actually shorter to sail through the Suez Canal.

As mentioned in Part 2, the world’s major container lines call on a number of ports and optimize their routes along ports that offer developed communication lines into the hinterlands, e.g. river transport and railroads, to distribute goods to customers and consumers. Since the NSR passes through mostly uninhabited territory no such stopovers are possible, strongly reducing the route’s attractiveness for regular liner service operators. In addition, more than 50 percent of trade between Europe and Far East passes through the port of Singapore, for which the NSR does not offer any time or distance savings.17) Hence, only goods that are shipped from point to point, e.g. crude oil, natural gas, and ore, and along certain routes pairs will benefit from shorter distances.

In addition, the costs of using the NSR are frequently understated or ignored. Besides the frequently cited costs for ice-breaker escorts shipping companies also incur significant indirect costs. In order to sail the NSR operators have to file for a permit with the Administration of the NSR four months in advance. Few operators are able or willing to plan that far in advance and deal with the bureaucracy of obtaining a permit. In comparison, the process of sailing through the Suez Canal only requires a 48-hour advance notice.

Vessels are only allowed to sail along the NSR after they have been inspected for ice worthiness by either the Murmansk Shipping Company or the Far Eastern Shipping Company. The operator bears the logistical costs associated with that inspection. Furthermore, during the inspection and during the actual transit of the NSR, operators often need to hire interpreters as pilots and ice-breaker crews seldom speak English.18)

Shipping operators also face significantly higher insurance premiums when sailing through the hostile Arctic environment. Navigating the NSR requires significant experience due to a dearth of accurate charts and the unavailability of the standard global positioning system (GPS) in high latitudes. In its place, a system called GLONASS, which is not compatible with some ships, is used along the NSR.

In sum these costs severely restrict the profit that can be materialized along the NSR. A recent study has shown that a 50 percent reduction in ice-breaker fees would be required to make liner service between Rotterdam and Yokohama profitable. Hence, profitability will for the foreseeable future be limited to a small number of specialized bulk carriers traveling along certain point to point routes.

China and the NSR

Part 4 of the series on the future of the Northern Sea Route (NSR) analyzed the potential for cost savings along the NSR and discussed how credible these claims are. The final part in this series will discuss China’s future as an Arctic Maritime Nation and take a closer look at its influence on the development of the NSR.

China has been very cautious about formulating and propagating its interests in the Arctic and continues to quietly advocate for unobstructed access to the region. China’s advocacy for unimpeded access to the region for all states, while certainly economically and politically self-motivated, may help it to garner significant support from the international community, especially smaller export- and import-dependent countries who would benefit from liberal access to the Arctic’s shipping routes.

China’s rising economic power, especially its role as a growing exporter to Europe and the United States, may allow it to overcome its position of weakness in Arctic affairs. The country is neither an Arctic littoral state, nor an observing member to the Arctic Council. Chinese Arctic research remains focused on the environmental impact of climate change in the region; economic, political, and security implications, however, are increasingly being considered. China’s economic development is highly dependent on international shipping and foreign trade contributes 46 percent to the country’s GDP.

China’s efforts to develop into an Arctic maritime nation and become a destination for Russia’s Arctic hydrocarbon resources are well documented. In addition to commissioning a number of ice breakers, the country continues to invest in ice-strengthened bulk carriers and tankers with dual-directional technology which combine the fuel-efficient bow of a cargo ship on one end and with the hardened bow of an icebreaker on the other.

Until recently China appeared to be wary of Russia’s intentions in the Arctic, e.g. the planting of the Russian flag at the North Pole, but cooperation has increased as of late. China National Petroleum Corporation recently signed an agreement with Sovcomflot, the largest operator of Arctic shuttle tankers and ice-class LNG carriers, to” develop a long-term partnership in the sphere of seaborne energy solutions, with the SCF fleet serving the continually growing Chinese imports of hydrocarbons.”19)

Chinese officials have repeatedly called the NSR the “Arctic Golden Waterway” and Bin Yang, a Professor at the Shanghai Maritime University, estimates cost savings between $60-120 billion per year if China makes extensive usage of Arctic shipping routes.20) At the same time, Russia’s GDP is closely tied to its Arctic natural resource development which in turn depends on the ability to deliver these resources to the global markets, e.g. via pipelines or the NSR. Russia is seeking to tap Asian demand for oil and gas to help justify developing remote deposits in the Arctic and eastern Siberia. Hence, Russia has a strong interest in developing the NSR into a commercially viable shipping route and ensuring access to one of the fastest growing consumer market for hydrocarbon resources: China and greater south-east Asia.

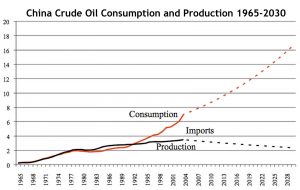

China’s efforts to gain a foothold in Arctic shipping must be seen as an attempt to diversify the trade routes of its oil and natural gas supply and thus overcome its strategic weaknesses known as “Malacca dilemma.” Currently 78 percent of China’s hydrocarbon imports pass through the narrow 1.5 mile-wide channel at the Strait of Malacca.21)

China’s demand for crude oil is slated to grow from 8.2 million barrels per day (mbd) in 2008 to 17 mbd 2030. Over the same period the production deficit of Asia as a whole will increase from 15 mbd to 48 mbd.22) China is not only attempting to secure access to Africa’s growing share of world petroleum exports, e.g. in Angola and Sudan, in order to satisfy its growing demand for hydrocarbon resources but also diversify the trade routes of its natural gas and oil imports. Becoming an Arctic maritime shipping nation represents an important step in China’s goal to achieve long-term energy security.

The series on The Future of the Northern Sea Route looked at a number of factors which determine if the route will develop into a “Golden Waterway” or remain a niche trade route. The rate of climate change in the Arctic, world trade patterns and global trade dynamics, the economics of shipping lanes and the potential for cost savings, and China’s role as a potential key benefactor of Arctic shipping, are key variables to the development of the NSR as global shipping route.

References