Arctic Shipping Potential Along the Northern Sea Route

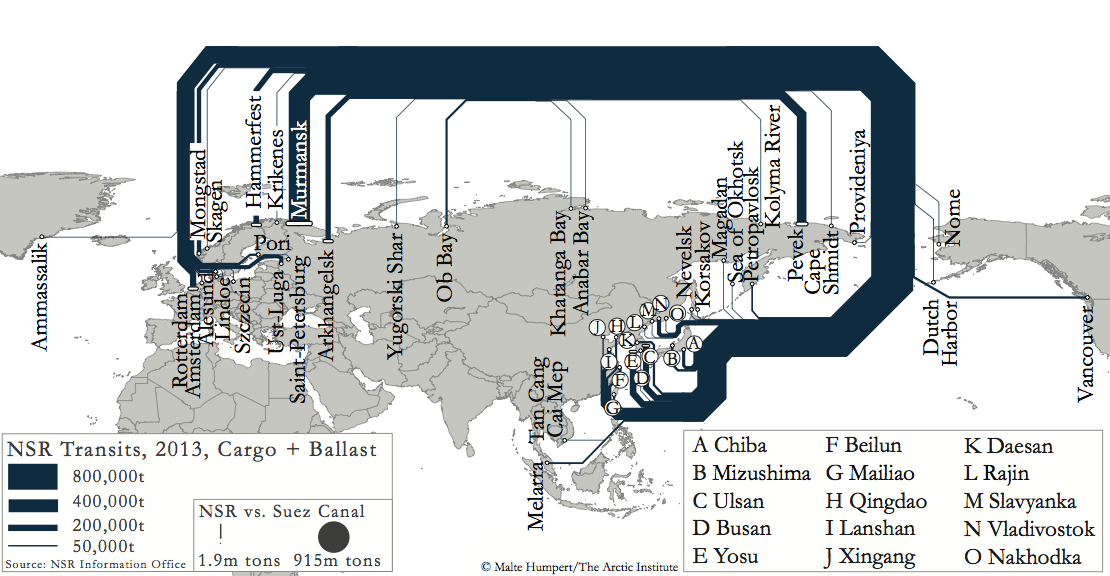

Northern Sea Route transits 2013. Photo: Malte Humpert

Expectations are high that Arctic shipping routes, particularly the Northern Sea Route (NSR), will rival traditional shipping routes and complement the Suez Canal route as a key waterway for trade to and from Asia by the middle of this century. How realistic are such scenarios? This report uses data from the 2013 NSR shipping season to identify and analyze traffic patterns, point out differences compared to the Suez and Panama Canals and draw conclusions about the future potential of the NSR.

Abbreviated version of the report in the 2014 Arctic Yearbook

Executive Summary

The 2013 shipping season on the Northern Sea Route (NSR) commenced on June 28 when the Russian-flagged vessel Varzuga, carrying 13,658 tons of diesel, entered the NSR at Cape Zhelaniya north of Novaya Zemlya. Over the course of 154 days a total of 49 vessels transported 1.35 million tons of cargo. A further 22 vessels transited the NSR unladen carrying 507,000 tons of ballast. The shipping season concluded on November 28 when the Russian-flagged vessel Bukhta Slavyanka exited the NSR at Cape Dezhnev in the Bering Strait.

The Northern Sea Route Information Office lists 71 transits for 2013 but a closer analysis of the data shows that only 41 vessels traveled the entire length of the NSR and qualify as full transits. An additional 23 vessels either departed from or arrived at ports inside the NSR and did not fully transit it. A further seven vessels traveled exclusively within the NSR. Of the 41 ships that transited the full length only 30 carried cargo, transporting 1.19 million tons.

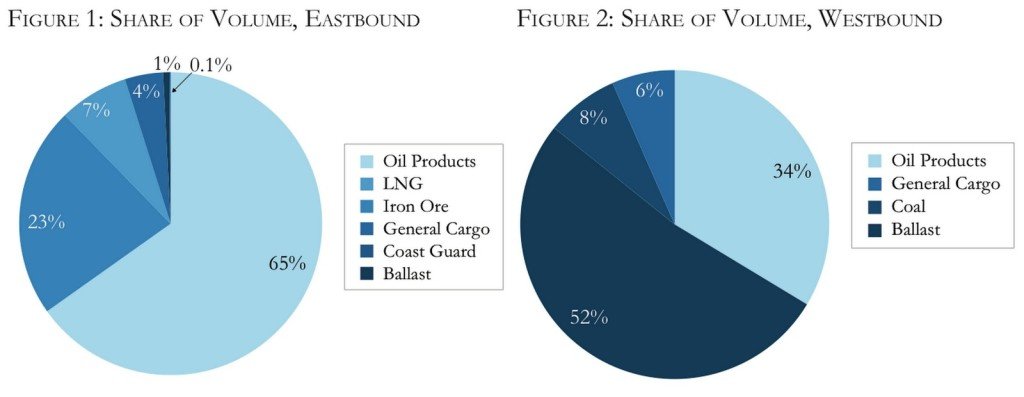

Oil products, including diesel, fuel oil, and naphtha, made up the lion’s share of cargo on the NSR in 2013. In total 31 vessels carried 911,000 tons of oil products representing 67 percent of all cargo. Iron ore accounted for 203,000 tons representing 15 percent of all cargo in 2013. General Cargo, also called break bulk cargo, accounted for 7.4 percent of goods on the NSR. Coal deliveries represented 5.5 percent of traffic. LNG accounted for 5 percent of all NSR traffic in 2013 and a single vessel, the Arctic Aurora, carried 66,868 tons of LNG from Hammerfest to Chiba.

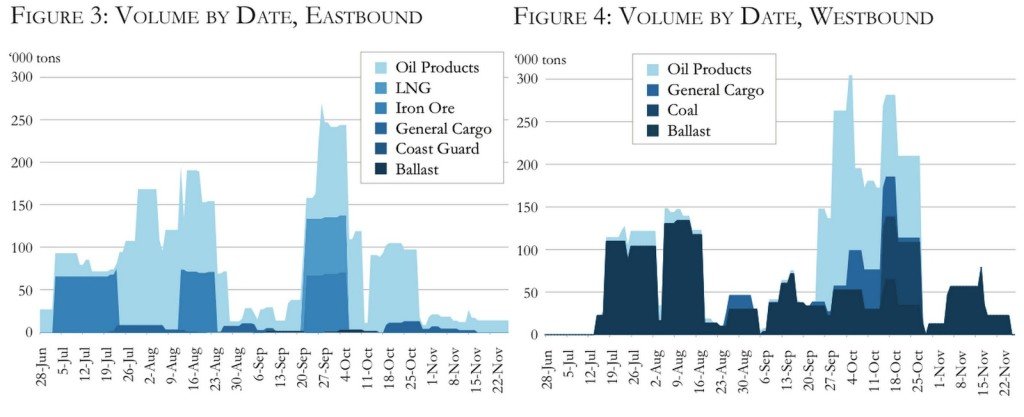

The 2013 season saw two distinct peaks in shipping activity. In eastward direction, supplies for local communities, mainly oil products, and two iron ore shipments dominated the first two months of the season, July and August. Unfavorable ice conditions near Severnaya Zemlya and in the East Siberian Sea during the first half of September led to a drop in traffic before a second peak emerged at the end of the month. Westbound traffic commenced around July 15, about two weeks after eastbound transits. The first peak in shipping activity occurred between July 15 and August 15. Almost all volume carried during this time consisted of ballast. The second increase in shipping in late September and October included primarily oil products, general cargo and coal.

The vast majority of transits, 54 of 71 journeys, originated in Russian ports and those vessels transported 705,000 tons, equal to 52 percent of all cargo. The lack of diversification, especially in terms of country of origin, is striking. The NSR is primarily utilized as a domestic supply and export route for Russia and much less as an international transportation corridor by countries in Europe or Asia. Key hubs for this regional shuttle service are Murmansk and Arkhangelsk in the west, Ob Bay in the center, and Pevek in the east. Out of 71 total transits, 43 were exclusively between Russian ports.

Traffic patterns on the NSR differ significantly between east- and westbound transits. In 2013, 40 vessels traveled eastbound carrying 895,000 tons in cargo and 6,000 tons of ballast. In contrast, the 31 westbound vessels carried 460,000 tons of cargo and 500,000 tons of ballast. The NSR exhibits a strong bias for eastbound journeys. Products, primarily natural resources, are shipped to the markets in Asia, with limited cargo shipped in the opposite direction. This imbalance in the flow of goods leads to a higher share of ships traveling the route empty and thus reduces profitability. In contrast to the Suez and Panama Canals, the NSR largely represents a one-way traffic route. After delivering cargo at ports in Europe or Asia few ships make the return voyage either with or without cargo via the NSR.

The NSR remains a niche trade route with limited numbers of true transits. The export of Arctic hydrocarbon resources, primarily from Russia, and their transport along the NSR can be expected to grow over the coming years. However, this will not establish the NSR as a true trade route but in contrast place even greater emphasis on one-directional traffic from west to east. Mr. Putin’s hope to establish the route as a northern export highway may yet be dashed by unfavorable market conditions, varying ice levels and the lack of available Russian icebreakers.