U.S. Waking Up to Arctic Resources?

U.S. Crude Oil Production 1990-2035. Chart: Bob Graham et. al

Since the end of the Cold War, U.S. interest in the Arctic has been steadily declining. While other countries have been eager to assert their position in the Arctic by issuing updated Arctic development and strategic plans, increasing military presence and planting flags, the Obama Administration has merely indicated that it generally agrees with the Arctic strategy already set forth by the preceding Bush government. In January 2009, the Bush administration released a new National/Homeland Security Presidential Directive on the Arctic during its very last days in office.

However, more recently Washington has shown some signs that it might want to join the group of countries vying for the Arctic’s resources, predominantly vast expected amounts of oil and gas. First, at the 7th Arctic Council Ministerial Meeting in Nuuk on 12 May 2011, for the first time a U.S. Secretary of State attended. Hillary Clinton was also accompanied by Secretary of the Interior Ken Salazar and Alaskan Senator Lisa Murkowski.

Second, there is a current debate in Alaska and within the U.S. government about opening up more state and federal land for resource development, and in June 2011 the House has passed legislation that would speed up approvals for drilling in the Arctic by removing regulatory hurdles.

Third, the U.S. is apparently interested in getting involved in the emerging hydrocarbon industry in Greenland as a number of Wikileaks cables from 2010 reveal that “Greenland might have reserves to rival Alaska’s North Slope”. And indeed, according to the United States Geological Survey (USGS), the U.S. has the second highest estimated Arctic oil and gas reserves with about 20% of the expected total. Furthermore, the largest Arctic oil deposits are expected in Arctic Alaska and the waters off Alaska’s coast in the Chukchi and Beaufort Sea rank behind only the Gulf of Mexico in estimated domestic resources. Alaska’s North Slope is the highest yielding oil field in the United States and Alaska is the second-ranked oil-producing state after Texas.

Given the country’s high dependency on foreign oil – 49% of petroleum consumed in 2010 was imported – and President Obama’s announcement to decrease this dependency by a third by 2025, Alaska could potentially play an important role to make the U.S. more self-reliant.

However, production of North Slope oil field has declined by more than two-thirds since its peak in 1988. This is part explains why oil companies have shown increasing interest in Alaska’s more promising offshore areas, for example Royal Dutch Shell’s drilling plans for the Beaufort and Chukchi Seas. But exploration activities are often hampered by court challenges and/or by the lengthy and often cumbersome process to obtain drilling licenses. This appears to be justified given that the ‘National Commission on the BP Deepwater Horizon Oil Spill and Offshore Drilling’ set up after the Gulf of Mexico oil spill disaster has come to the conclusion that more and more stringent precautionary measures, monitoring, containment and response plans have to be set up before moving on with Arctic oil and gas exploitation.

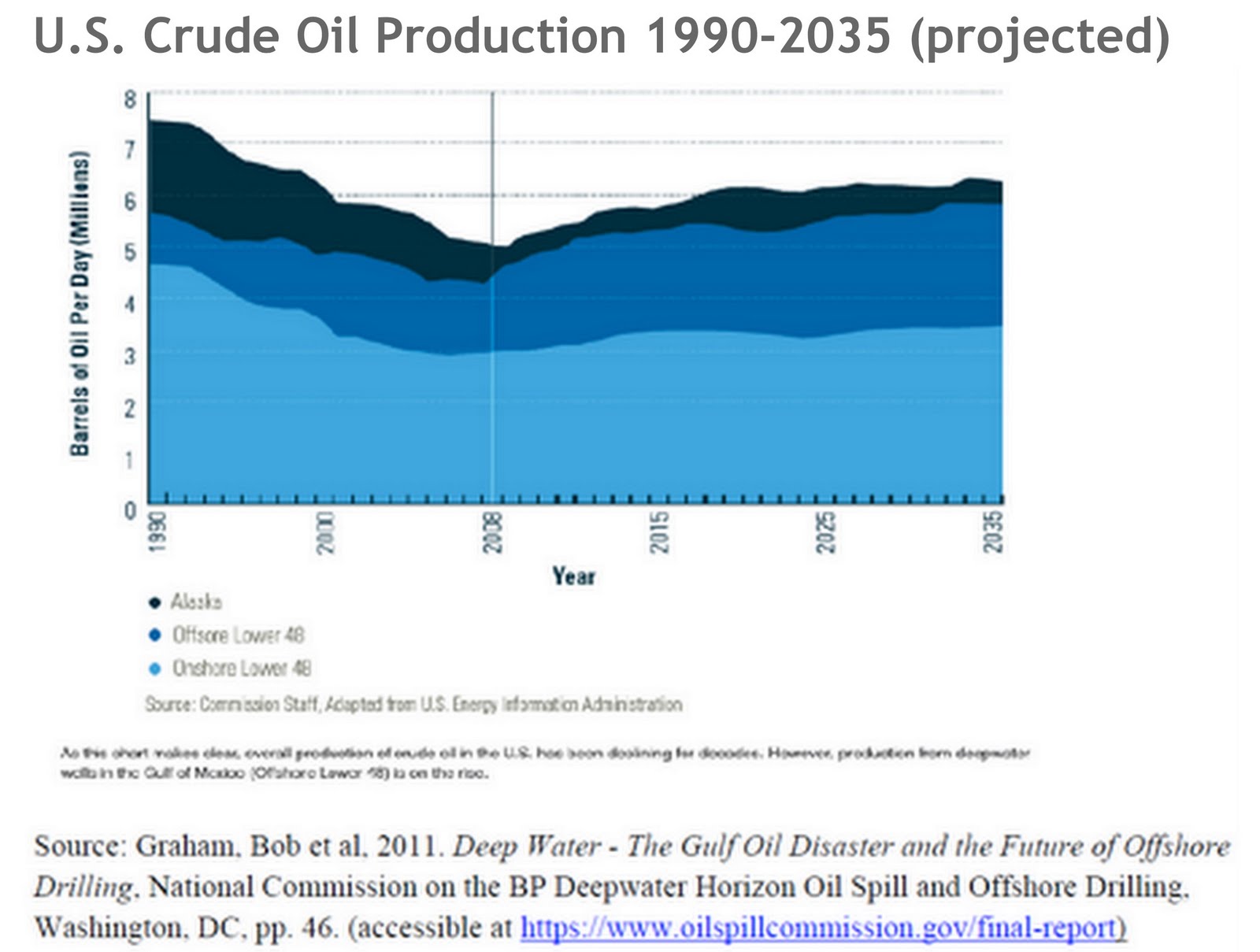

On top of that, Arctic oil resources are not and are not expected to become a major part of U.S. oil production. The biggest part of U.S. crude oil production has been and will remain onshore production in the lower 48 states, although these sources are declining. In contrast, offshore resources in the lower 48 states are on the rise, especially due to production from deepwater wells in the Gulf of Mexico.

And what about Arctic gas? The U.S. currently satisfies the majority of its gas consumption with domestic resources. In 2009, 87% of the natural gas consumed in the U.S. was produced domestically. Further, gas estimates for Arctic gas in North America are far less impressive than the estimates for Eurasia. Most importantly, the U.S. energy market has in recent years experienced a major overhaul what some have called ‘America’s Natural Gas Revolution’.

Shale gas has proven to be the crucial game changer. U.S. production share of unconventional gas increased from 10% in 1990 to 40% today with more potential expected.New technologies such as horizontal drilling and so-called ‘fracking’ allow access to the plentiful natural gas reserves locked up in shale’s. The EIA’s Annual Energy Outlook 2011 estimated that the U.S. has recoverable unproved shale gas resources of 827 trillion cubic feet.

Hence, Arctic gas reserves, which are much harder to recover, become less attractive for the U.S. market. The current oversupply of the gas market as well as the aftereffects of the global financial and economic crisis in form of decreasing demand adds to the unattractiveness of Arctic gas. According to the US Energy Information Administration, Alaska has a substantial natural gas production most of which is associated gas extracted as a by-product of oil production in the North Slope; however, processing of this supply is not commercially feasible and thus has no way of reaching consumption markets.

Overall, the growing U.S. involvement in the Arctic does not seem to stem from its interest in the region’s untapped oil and gas resources. Given its large contribution to U.S. crude oil production and its expected remaining capacity, offshore production in the Gulf of Mexico is likely to be more effective to meet the government’s oil independence goals.